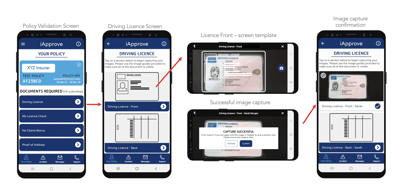

13 January 2022: 1 Answer Insurance has today announced a partnership with Inzura.ai to deploy the innovative AI powered policy verification app, iApprove, as part of a wider initiative to digitise their business delivering financial and service improvements for their taxi, courier, minibus and private motor insurance lines.

Many of you will know Inzura for our innovative app-based telematics solution and our InzuraGo policy admin app - both products are groundbreaking in their own way, with both focussed on delivering efficiencies to our broker customers along with a compelling engaging experience to the policyholder. This customer centric approach is our guiding principle and along these lines I’m pleased to say that we are now ready to announce our next generation product iApprove.

At Inzura we collect and process huge amounts of data for each our insurance clients each month. We manage GPS location data for telematics, app usage data, policy document photos, vehicle and property data as well as video files from dashcams. We generate insight from this data to help with tactical issues like cost savings and fraud detection but also do aggregate analysis for longer term strategic product planning and pricing. We are constantly looking for ways to enhance the data-driven intelligence and insight we deliver to our insurer and broker customers.

Young drivers are typically being targeted by insurers with higher insurance premiums due to little experience on the road. But let's face it, there are plenty of experienced drivers who have adapted bad habits and are not necessarily good drivers, thus posing a risk to others on the road, as well as themselves. Thanks to telematics and AI driven insurance platforms being designed by insurtechs such as Inzura, more and more insurers are starting to gather individual driving data, highlighting the likely hood of being at risk of causing an accident. Those that stay low risk, are being rewarded by having insurance premiums reduced relevant to their risk ratio. Many drivers are often not even aware that their driving behaviour is risky or reckless.